Why send with Simplii? Glad you asked.

No Simplii transfer fees

Send up to $75,000 worldwide to 130+ countries2

Great foreign exchange rates

Send real-time transfers to a digital wallet, or send a same-day cash pickup

Looking for other ways to transfer?

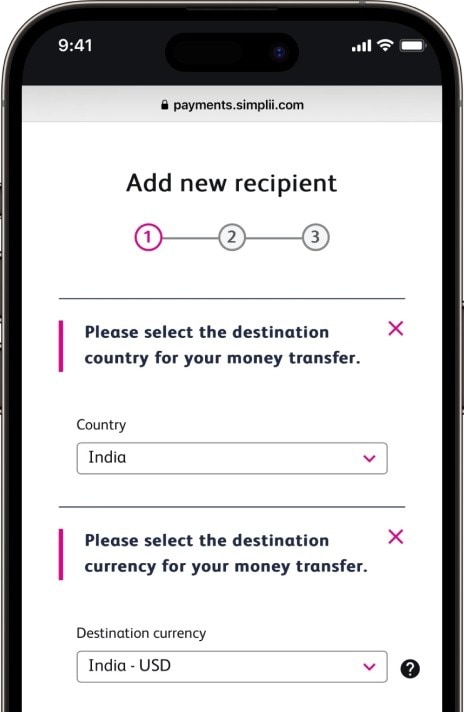

Send in USD worldwide

Send in USD to over 60 countries quickly and with no Simplii transfer fees

Send money from your U.S. dollar account to local currency, or your Canadian dollar account to USD or the country’s local currency.

Welcome offer

Bank with Simplii and start earning

Get our new client offer when you open a No Fee Chequing Account.

- No monthly fees, no minimum balance

- Free access to all CIBC ATMs across Canada

- Free unlimited Interac e-Transfer® transactions

- A debit card that works anywhere Mastercard® is accepted — online and abroad

CONDITIONS APPLY.