It's simple. With a no-fee chequing account, you get free daily banking

Life’s always busy and you work hard every day for your money — it’s time for your bank account to do the same.

Enjoy unlimited debit purchases, bill payments and withdrawals.

Setting up direct payroll deposits, account-to-account transfers and pre-authorized bill payments is easy.

Add overdraft protection if you need it.

Want your money to grow? Check out our High Interest Savings Account.

Start banking with the best

Benefits and features

- Free daily banking

- Skip the monthly fees

- Free access to over 3,400 CIBC ATMs across Canada

Debit Mastercard

More reasons to love this account

Have your cheque deposited directly into your Simplii account and have access to your money right away. To download your direct deposit form, sign in to Online Banking and select "More Services".

Set up automatic payments and pay your bills on time, every time. To download your Automatic Payments form, sign in to Online Banking and select "More Services".

Only available on our No Fee Chequing account. You can qualify for limits up to $5,000. A monthly charge of $4.97 applies only when you use this service, in addition to a fixed interest rate of 19% on overdraft balances. Overdraft protection can help you in a short-term bind. For long-term solutions, look at our Personal Line of Credit or a Personal Loan.

Make transferring money between accounts a breeze. Set up automatic transfers through your online banking.

Bring a friend. Earn $125. Repeat.

Earn $125 each time a friend opens a No Fee Chequing Account or another eligible account using your unique referral link. Share your link and spread the word — your friends will get $50 too.ⓘ

Interest rates

|

|

|---|---|

$0.00 to $50,000.00 |

RDS%rate[3].false.Published(undefined,0.00-50000.00,annual_rate,undefined-undefined-undefined-undefined-undefined)(#O2#)% |

$50,000.01 to $100,000.00 |

RDS%rate[3].false.Published(undefined,50000.01-100000.00,annual_rate,undefined-undefined-undefined-undefined-undefined)(#O2#)% |

$100,000.01 to $500,000.00 |

RDS%rate[3].false.Published(undefined,100000.01-500000.00,annual_rate,undefined-undefined-undefined-undefined-undefined)(#O2#)% |

$500,000.01 to $1,000,000.00 |

RDS%rate[3].false.Published(undefined,500000.01-1000000.00,annual_rate,undefined-undefined-undefined-undefined-undefined)(#O2#)% |

$1,000,000.01 and up |

RDS%rate[3].false.Published(undefined,1000000.01-undefined,annual_rate,undefined-undefined-undefined-undefined-undefined)(#O2#)% |

Interest is calculated by multiplying the daily interest rate for each tier by the portion of the daily closing balance in that tier.

Rates subject to change without prior notice.

|

|

|---|---|

On all overdraft balances |

RDS%rate[3].true.Published(undefined,undefined,annual_rate,undefined-undefined-undefined-undefined-undefined)(#O2#)% |

A monthly charge will apply when you use this service, in addition to a fixed interest rate on overdraft balances.

Sometimes you need more than day-to-day banking.

Find what you need in our Costs for special requests and additional items in the Products and Services Agreement.

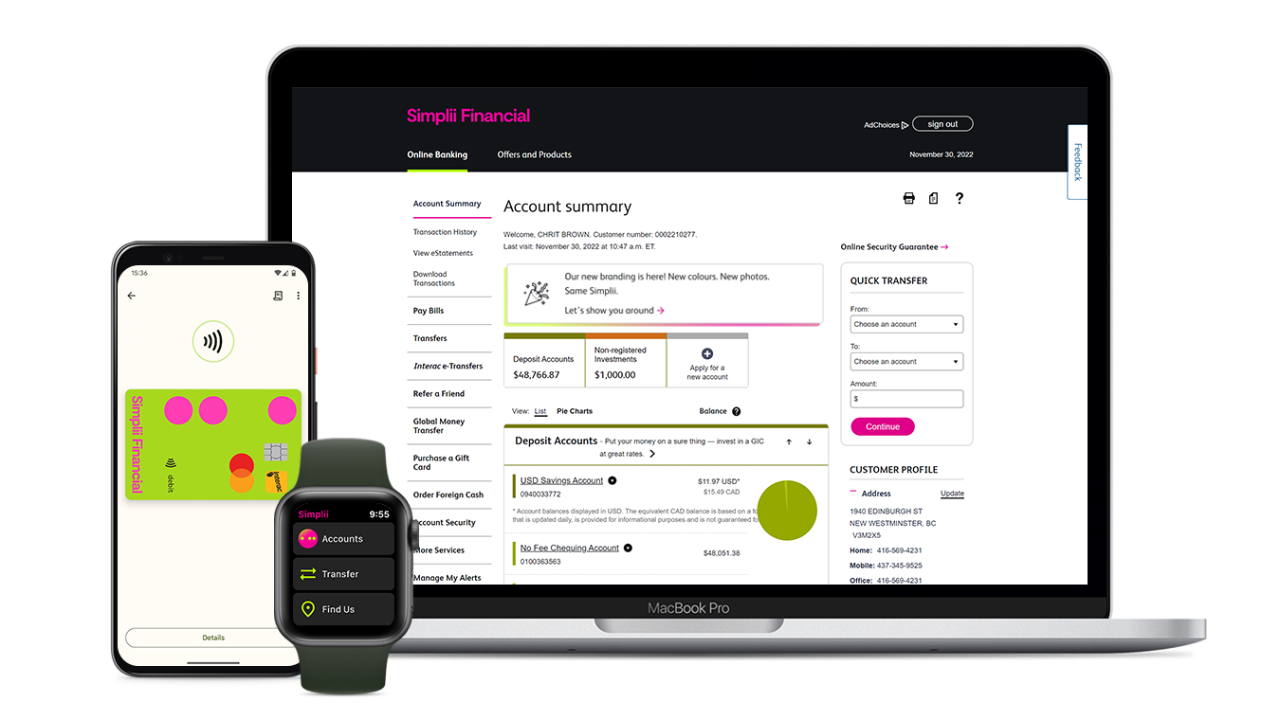

Go digital to fit your lifestyle

- Turn your phone into your wallet with mobile payment

- Send, request and receive money for free with Interac e-Transfer®

- Transfer money internationally with $0 transfer feesⓘ using Global Money Transfer

- Get free delivery to your home or nearest Canada Post when you order foreign cash

- Use your Simplii sign on details to access over 80 government of Canada websites

Get the perks of no-fee daily banking with the New to Canada Banking Program. Complete the application online before you arrive or once you're here. Starting a new life can be complicated, but your banking doesn't have to be.

Digital banking has never been so simple. With Interac® document verification service, you can verify your identity safely from the comfort of your own home.