Accessibility links

Why join Simplii

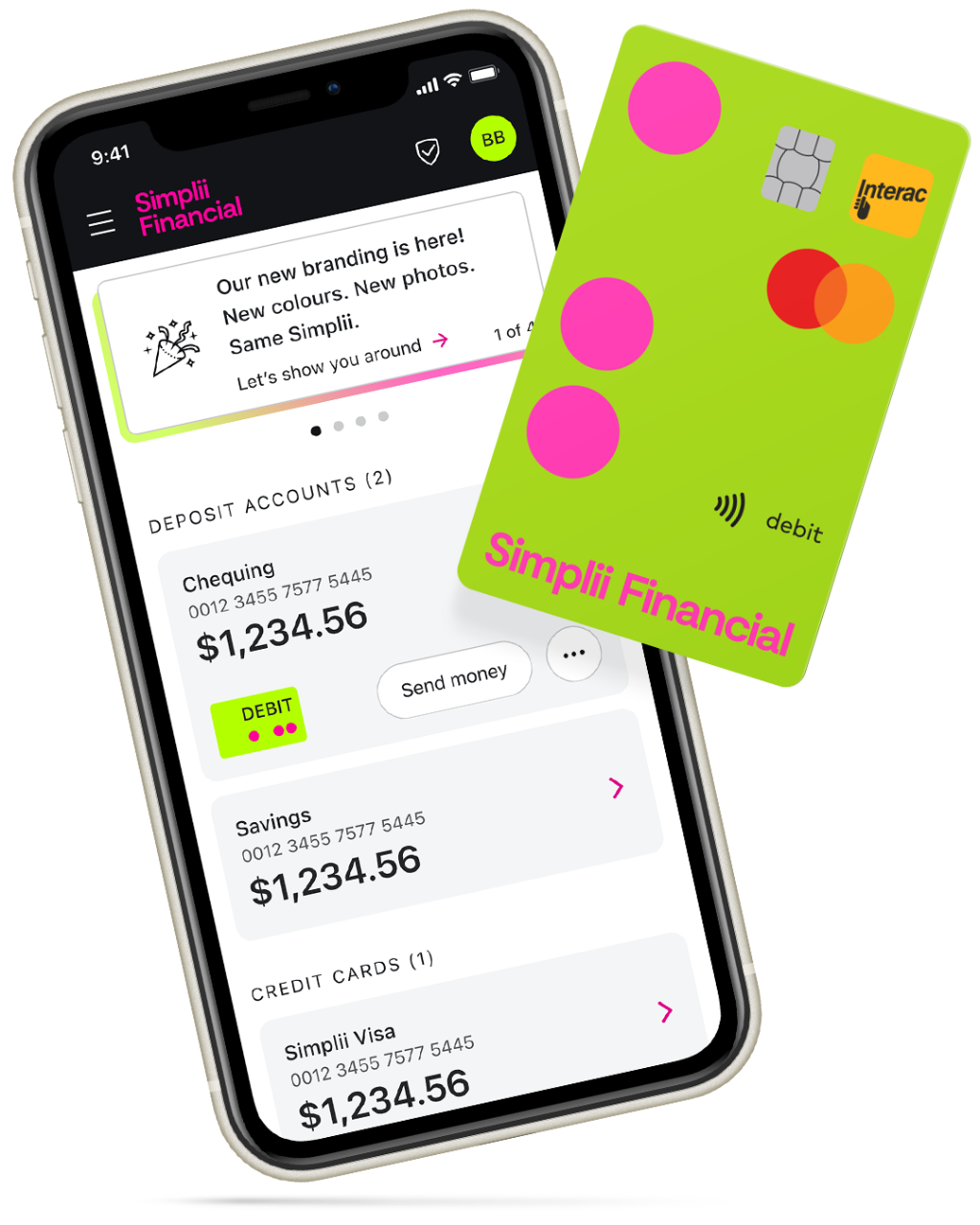

Use your computer, mobile device or any CIBC ATM to bank at your convenience. Your money is always where you are.

Simplified banking is our promise to you. There are some people who like what we do as well.

We’re always working on new ways to improve your digital banking experience. Explore some of our new and upcoming features.

Bring a friend. Earn $125. Repeat.

Earn $125 each time a friend opens a No Fee Chequing Account or another eligible account using your unique referral link. Share your link and spread the word — your friends will get $50 too.ⓘ

A No Fee Chequing Account is free daily banking with unlimited debit purchases, bill payments and withdrawals. It’s our most popular account for setting up direct payroll deposit and pre-authorized bill payments, and there is no need to carry a minimum balance. Account-to-account transfers are easy and Overdraft Protection can be added. A No Fee Chequing Account is designed for day-to-day banking. If you want your money to grow, check out our High Interest Savings Account.

The Simplii Financial™ Cash Back Visa* Card can be used anywhere Visa* is accepted for in-person and online purchases, has no annual fee and offers the ability to earn cash back. New purchases are not charged interest if your balance is paid in full by the payment due date every month. Your payment due date is 21 days from your monthly statement date. You should make required monthly payments on time or the interest rates applicable to your account could increase. Interest is always charged for Cash Advances, Balance Transfers or Convenience Cheques — making it worth your time to inquire into our unsecured Personal Line of Credit.

Start your life in Canada with our banking offers

Start your life in Canada with our No Fee Chequing Account and Visa* credit card

Earn student benefits with our No Fee Chequing Account and Cash Back Visa* card

A High Interest Savings Account lets you easily save your money without having it locked away for an extended period of time. There are no monthly or transaction fees, no minimum balance required and great interest rates are earned on every dollar. This account can be set up for automatic deposits but it isn’t meant to offer all the conveniences of our No Fee Chequing Account. A High Interest Savings Account isn’t available for ATM or Point-of-Sale transactions like our No Fee Chequing Account — which is the best choice for day-to-day banking.

A Personal Line of Credit is a revolving source of funds, up to an approved amount, that you can access when you need them. Any amount you repay is accessible to you again without reapplying. A line of credit lets you write cheques and make ATM withdrawals, and you only pay interest on the funds you use. It’s the preferred choice over a credit card if you plan on carrying a balance for an extended period of time. Check out our Simplii Financial™ Cash Back Visa* card if you want available credit and intend to pay off your balance every month.

A No Fee Chequing Account is free daily banking with unlimited debit purchases, bill payments and withdrawals. It’s our most popular account for setting up direct payroll deposit and pre-authorized bill payments, and there is no need to carry a minimum balance. Account-to-account transfers are easy and Overdraft Protection can be added. A No Fee Chequing Account is designed for day-to-day banking. If you want your money to grow, check out our High Interest Savings Account.

A High Interest Savings Account lets you easily save your money without having it locked away for an extended period of time. There are no monthly or transaction fees, no minimum balance required and great interest rates are earned on every dollar. This account can be set up for automatic deposits but it isn’t meant to offer all the conveniences of our No Fee Chequing Account. A High Interest Savings Account isn’t available for ATM or Point-of-Sale transactions like our No Fee Chequing Account — which is the best choice for day-to-day banking.

A USD Savings Account lets you grow your U.S. dollars with a great exchange rate. You can transfer funds from your Simplii Financial Canadian Dollar accounts to your USD Savings Account at great rates, and easily send money to over 130 countries around the world with a Global Money Transfer. There is no minimum balance required, no monthly service fees and you can deposit USD and non-USD cheques into the account. You can’t make cash deposits or withdrawals with a USD Savings Account and there is no ATM access or Point-of-Sale capability at this time. Check out our No Fee Chequing Account for day-to-day banking.

Transfer funds into your EUR, GBP, INR, CNH and PHP account from another Simplii Financial account at competitive exchange rates. There is no minimum balance required, no monthly account fees and no transfer fee to send money to the home country of the currency (i.e. INR to India, PHP to Philippines etc.).ⓘ You can’t make cash deposits or withdrawals and there is no ATM access or Point-of Sale capability with the Foreign Currency Savings Accounts at this time. For your day-to-day banking needs, the Simplii Financial No Fee Chequing Acount is your best choice.

The Simplii Financial™ Cash Back Visa* Card can be used anywhere Visa* is accepted for in-person and online purchases, has no annual fee and offers the ability to earn cash back. New purchases are not charged interest if your balance is paid in full by the payment due date every month. Your payment due date is 21 days from your monthly statement date. You should make required monthly payments on time or the interest rates applicable to your account could increase. Interest is always charged for Cash Advances, Balance Transfers or Convenience Cheques — making it worth your time to inquire into our unsecured Personal Line of Credit.

A mortgage is a loan secured by your home or other property, and registered as a charge or line on the title. Simplii, a division of CIBC, connects you with CIBC mortgage specialists who will help you with your mortgage needs and assist you with your questions every step of the way.

A Personal Line of Credit is a revolving source of funds, up to an approved amount, that you can access when you need them. Any amount you repay is accessible to you again without reapplying. A line of credit lets you write cheques and make ATM withdrawals, and you only pay interest on the funds you use. It’s the preferred choice over a credit card if you plan on carrying a balance for an extended period of time. Check out our Simplii Financial™ Cash Back Visa* card if you want available credit and intend to pay off your balance every month.

A Secured Line of Credit is a revolving source of funds, up to an approved amount, that you can access when you need them. Also referred to as a Home Equity Line of Credit, the funds in this account are secured against your property. A line of credit lets you write cheques and make ATM withdrawals, and you only pay interest on the funds you use. Simplii Financial, a division of CIBC, connects you with a CIBC specialist to explore secured lines of credit. A dedicated CIBC mortgage specialist will assist you, every step of the way. If you wish to have a Line of Credit that isn’t secured against your property, check out our Personal Line of Credit.

A Personal Loan is a convenient way to borrow a lump-sum amount. You can have peace of mind repaying the loan with fixed monthly payments over a predetermined period, or prepay your loan at any time without penalty. Simplii offers competitive fixed interest rates and variable interest rates. If you want access to borrowed funds only when you need them, review a Personal Line of Credit. Unlike a Personal Loan, a line of credit lets you write cheques and make ATM withdrawals, and you only pay interest on the funds you use.

Be protected when unexpected things happen

An RRSP is meant to provide income after you retire. There is no minimum age requirement to open, as long as you've earned income and filed a tax return. Contributions are tax deductible but when you withdraw any funds, the amount is taxable unless, for example, you are eligible to use the funds as a first-time home buyer. Withdrawals are considered as income and may impact amounts you receive from income-tied government benefits or credits, whereas withdrawals from a Tax-Free Savings Account are not considered as income and do not impact amounts you receive from income-tied federal government benefits or credits.

Start with as little as $100 and earn a guaranteed rate

A Tax-Free Savings Account (TFSA) is designed to help you save money for a wide range of goals — not just retirement. Contributions are not tax deductible, but all the interest and income earned is tax free. Any money you withdraw is tax free too. You can access funds from your TFSA any time without penalty and recontribute up to your personal TFSA contribution room. You get competitive interest rates and there is no need to keep a minimum balance. Unlike a Registered Retirement Savings Plan, you don’t need to close your account when you reach a certain age. If saving for retirement is what you are looking to do, then an RRSP may also be appropriate for your needs.

Save even more with a management fee discountⓘ

Services that suit your needs

Order foreign currency online and get it delivered free to your home or nearest Canada Post office.

Pay tuition and take care of loved ones around the world with $0 transfer fees.ⓘ

Use your Simplii online banking information to sign in to over 80 Government of Canada sites.

Bank your way

Bank online, on your mobile device or at any CIBC ATM. Need help? Our call centre is always open.

No more digging around for coins or cards. Just tap your phone to pay.

Bank without worry. We use multiple layers of protection to help keep your information safe.

Can't find what you're looking for?

Here are the top matches for your search.

Other questions people were interested in.